Seamless private party auto loans without the work

We handle title, payment, and seller verification—so your members can get financed quickly and easily.

How Great Basin FCU is modernizing private party auto loans with KeySavvy.

Safer, simpler private party sales—for both you and your members

KeySavvy processes private party transactions as a licensed dealer, simplifying the entire process for your operations team.

We take care of title verification, lien payoffs, seller coordination, and paperwork, so you can offer more loans with less hassle. Your members get a seamless, tech-driven checkout experience with live customer support.

Your lien is perfected

Secure online payment for buyers and sellers

Guided checkout + live support

Payment

Docs

Transfer

Stop chasing titles

Our process, technology and team have you covered.

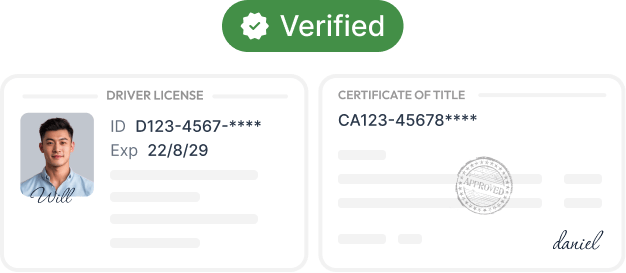

Seller & Title Verification

We provide detailed instructions to the seller for signing their title with support for co-owners, business owners, trusts and POAs.

Lien Payoff

If the seller has a loan, we get the payoff, pay the lienholder and receive the title. No coordination needed from your team.

Reduced Lien Perfection Risk

We assign you as the lienholder and complete registration on the buyer's behalf.

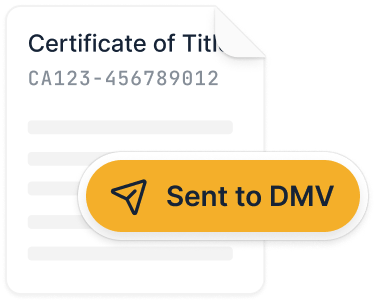

Simple to launch.

Customized for you.

No need to integrate with your loan origination system. We'll create a dedicated KeySavvy page for your credit union. Once a buyer is approved, simply share the link and KeySavvy will guide them through the rest of the transaction.

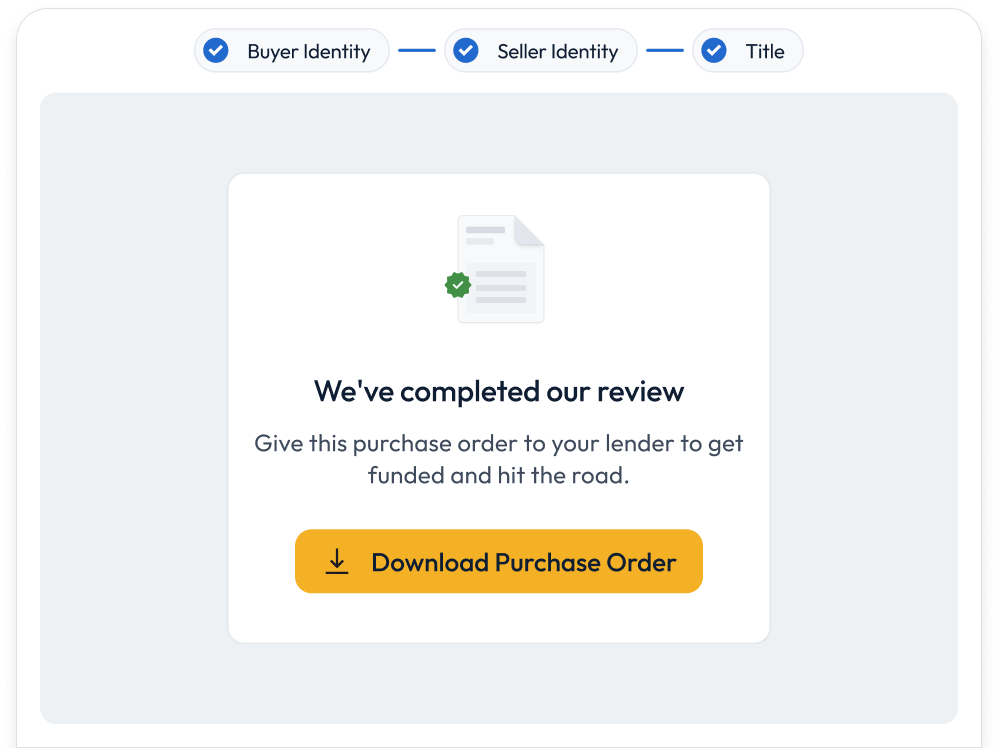

Once the buyer and seller complete identity and title verification, we generate a dealer purchase order with funding instructions for your team. Fund confidently via ACH to accelerate the process—KeySavvy guarantees the title.

Want a deeper integration? We can white-label our platform and embed the full experience on your site. Our API allows you to pass member and vehicle data directly, enabling a seamless experience.

Buyers and sellers love KeySavvy

As a Public Benefit Corporation, we're serious about trust.

Their seamless assistance in purchasing your new car, simplified payment process, live group chats, and shipping recommendations showcase their commitment to excellent service especially for out-of-state transactions.

Jose M.

The entire transaction was SO FAST. Fast payment and great communication when I had questions.

Cameron C.

KeySavvy put myself and the seller at ease with the verifications of both parties and the steps required to get through certain "gates" before proceeding to the next step. Couldn't be happier.

Cory S.

KeySavvy was in control at every step, notifying the seller when he needed to do something and me when I needed to do something. The price was well worth it for alleviating numerous restless nights of worry.

James C.

We were buying a car from out of state from someone we didn't know. They do ALL the paperwork, check on the buyers, and then figure it all out, send us all the paperwork. No worries, whatsoever!

Amy F.

The support line was very responsive and helpful. The buying process was quick and smooth. I saw the vehicle on Tuesday, got verified and bought the truck by Friday afternoon.

David M.

I was struggling to buy an out of state car from a private seller remotely without risk of fraud. The process was easy to follow, moved quickly and gave both me and the buyer peace of mind.

Matt C.

We used it to sell first and turned around a week later and used it to buy a car. They take care of all the hassle. They protect both parties throughout and take care of the title and bank paperwork. Worth every penny.

Kara P.

A great system that takes a lot of the doubts and issues away from the process of buying a car. They even sent me temporary plates, which is a hurdle when buying from a private seller.

Gustav J.

We were buying a car through a private seller 4 states away. KeySavvy totally solved this issue and soothed our concerns. They sent emails for each step and verified the title and our funds until we could pick up our car.

Autumn S.

A hundred bucks is a small price to pay for massively improved confidence and peace of mind, a huge reduction in cognitive and logistical load, and quite literally saving me from my usual experience of vehicle-buying overwhelm.

Michael M.

Proven at scale.

Trusted nationwide.

18k+

Completed transactions

$450M+

Total vehicles sold

50

US states we've served

5,000+

Credit union members served

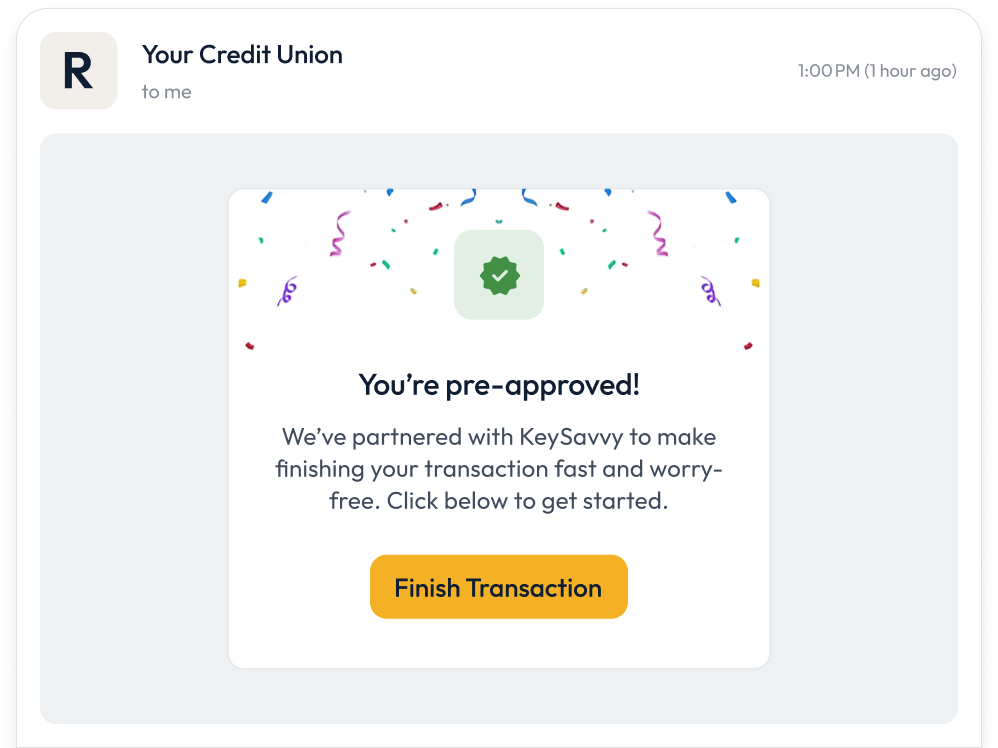

Turn private party auto loans into a competitive advantage

Partnering with KeySavvy means more than just simplifying operations. It's about delivering a secure, modern experience that builds loyalty and opens doors to future growth.

Convert more apps to loyal members

Grow your P2P direct lending volume

Deliver an experience your members will rave about

Find out how we can support your team

Let's transform your private party auto loan process into an experience that delights members and builds lasting loyalty.